Monetary Policy in India Uses Which of the Following Tools

The discount rate base rate is an interest rate charged by a central bank to banks for short-term loans. Here are the four primary tools and how they work together to sustain healthy economic growth.

Monetary Policy Of A Country With Diagram

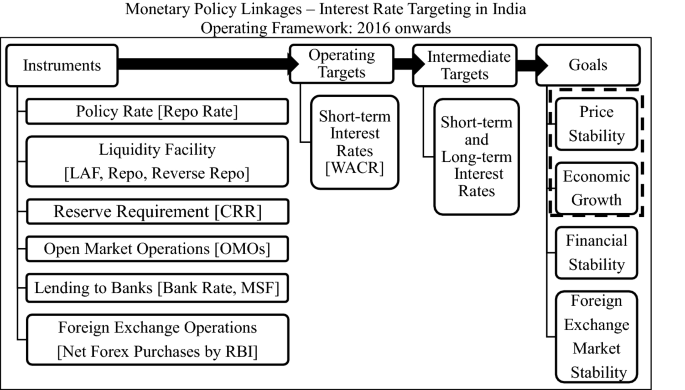

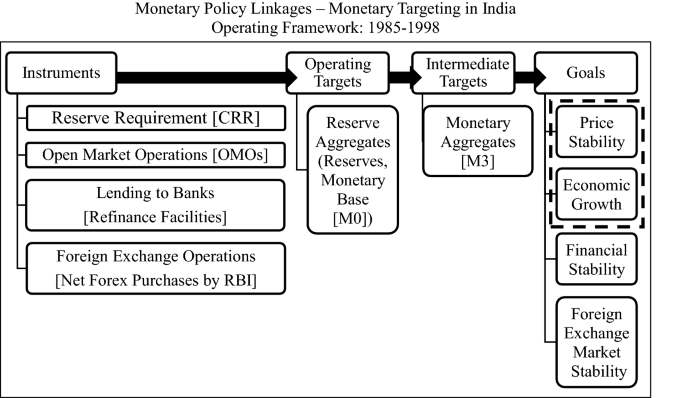

The main instruments of the monetary policy are Cash Reserve Ratio Statutory Liquidity Ratio Bank Rate Repo Rate Reverse Repo Rate and Open Market Operations.

. Quantitative Instruments or General Tools The Quantitative Instruments are also known as the General Tools of monetary policy. The various instruments of monetary policy include variations in bank rates other interest rates selective credit controls supply of currency variations in reserve requirements and open market operations. Tools of the monetary policy.

Positive impact - It is a quick fix to control inflation. The monetary policy tools are divided into Quantitative tools and Qualitative tools which regulate the money supply indirectly and directly in the economy respectively. The widely utilized policy tools include.

It was established in 1935 under a special act of the parliamentThe RBI is the main authority for the monetary policy of the country. By increasing CRR commercial banks need to deposit more money with RBI. Monetary Policy UPSC Notes-Download PDF Here.

Definitions and Examples of Monetary Policy. The RBI is the central bank of India. The main functions of the RBI are to maintain financial stability and the required level of liquidity in the economy.

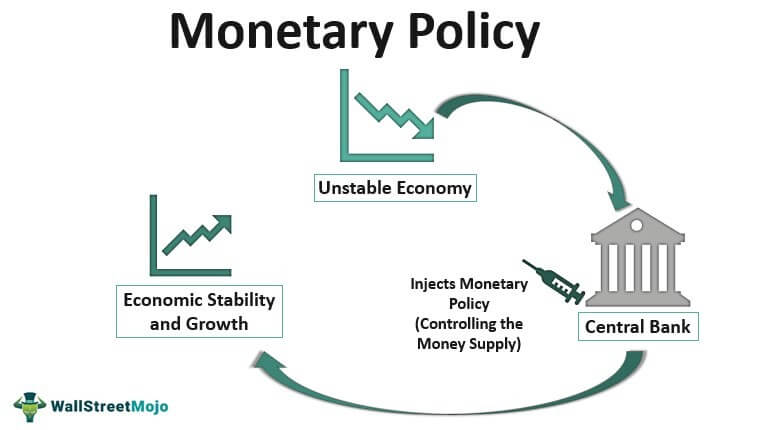

Monetary policy increases liquidity to create economic growth. By managing the money supply a central bank aims to influence. The first tool of monetary policy is Open Market Operations which refer to the buying and selling of financial instruments by central banks.

In a developing country like India the monetary policy is significant in the promotion of economic growth. Monetary policy is the control of the quantity of money available in an economy and the channels by which new money is supplied. Under Monetary policy RBI uses following tools.

There are two types of instruments of the monetary policy as shown below. Tools of Monetary Policy. Thus commercial banks left with less money.

Central banks use interest rates bank reserve requirements and the number of government bonds that banks must hold. Posted by Aditya Chauhan The monetary policy in India uses which of the following tools. Monetary policy is dictated by central banks.

Attempt Now A cistern has a leak which would empty the cistern in 20 minutes. The CRR requires every commercial bank to have reserves in terms of cash and gold. Monetary Policy Tools are instruments used by the central bank in India it is the Reserve Bank of India RBI in order to regulate the money supply in the economy under its monetary policy.

Less money with Commercial banks Less money with people Lower demand for goods and services Lower prices. These instruments are used to regulate the total amount of money and volume of bank credit in the economy. In India the central monetary authority is the Reserve Bank of India RBI.

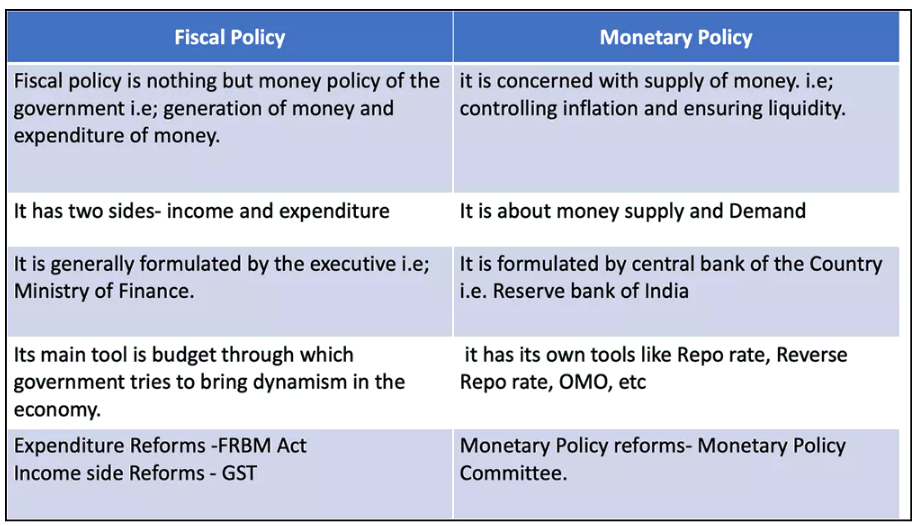

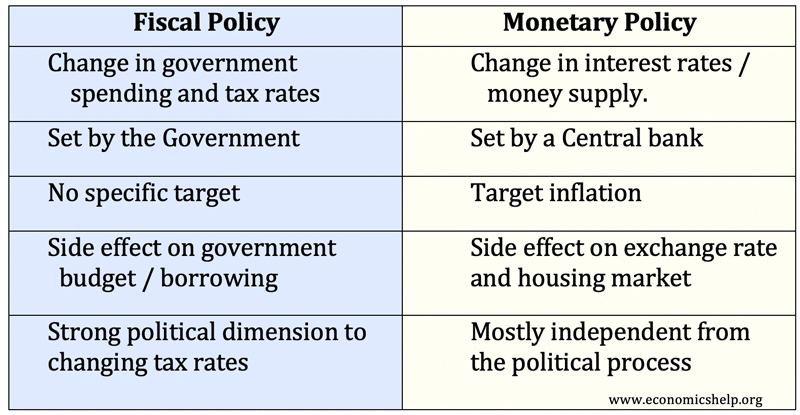

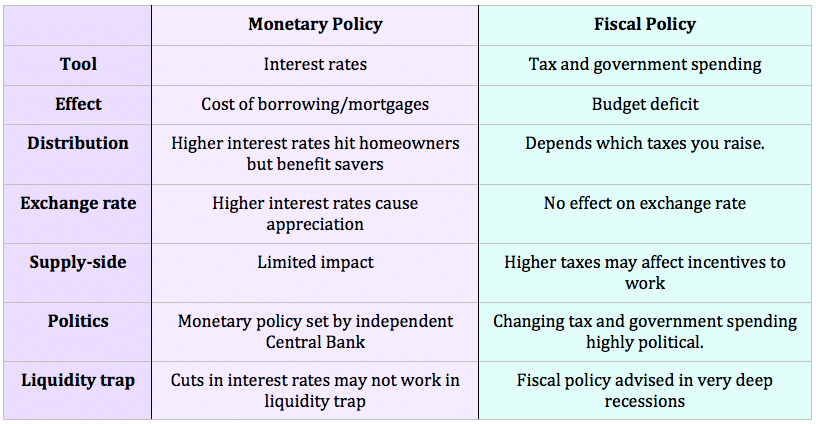

The tool used by the government in which it uses its tax revenue and expenditure policies to affect the economy is known as Fiscal Policy. According to the fourth bimonthly policy of 2018-19 CRR is 4 and SLR is 195. The Reserve Bank of India RBI uses the monetary policy to manage liquidity or money supply in a manner that balances inflation and at the same time aids growth.

It is a monetary policy tool used by RBI to control the liquidity in the banking sector. All these tools affect how much banks can lend. Monetary policy in India is governed by RBI through various tools like.

Most central banks also have a lot more tools at their disposal. The main three tools of monetary policy are open market operations reserve requirement and the discount rate. The reserve requirement open market operations the discount rate and interest on reserves.

The RBI sells government. A central bank can influence interest rates by changing the discount rate. Central banks use various tools to implement monetary policies.

Public revenue Select the correct answer using the code given below. After the cut on 29 September. An open market operation is an instrument which involves buyingselling of securities like government bond from or to the public and banks.

Public revenue Select the correct answer using the code given below question related to Medium-EnglishCDSPrevious years question papersEconomics. The RBI also controls and regulates the currency system of our economy. 31 Cash Reserve RatioCRR Commercial Banks are required to hold a certain proportion of their deposits in the form of cash with RBI.

The monetary policy in India uses which of the following tools. It is used to achieve macroeconomic objectives like inflation consumption growth and liquidity. The Reserve Bank of India.

Monetary policy is administered by the government of the country whereas fiscal policy is administered by the. Banks earn a certain amount of return on money reserved as CRR. The instrument of monetary policy are tools or devise which are used by the monetary authority in order to attain some predetermined objectives.

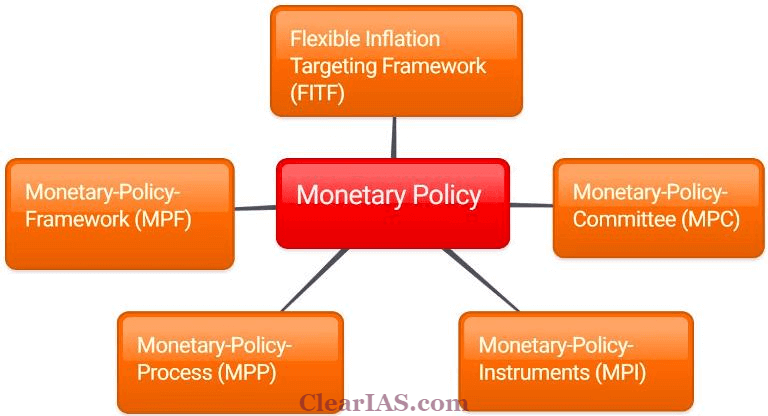

The tool used by the central bank to regulate the money supply in the economy is known as Monetary Policy. Monetary policy is the process by which the monetary authority of a country generally the central bank controls the supply of money in the economy by its control over interest rates in order to maintain price stability and achieve high economic growth. The volume of loans affects the money supply.

CRR is the minimum amount of cash that commercial banks have to keep with the RBI at any given point in time. With reference to Cash Reserve Ratio CRR in India consider the following statements. Content Developer Reviewer.

Open market operations 3. Now loans become dearer so people have less money. Open market operations 3.

Some of the following instruments are used by RBI as a part of their monetary policies. Quantitative tools also known as the Reserve Bank of Indias general tools are instruments linked to the quantity and volume of money as the name implies. In which year and at which place Indias national anthem was sung for the first time.

It is designed to maintain the price stability in the economy. Cash Reserve Ratio Statutory Liquidity Ratio Open Market Operations and Repo. It reduces liquidity to prevent inflation.

What are the instruments of monetary policy. Central banks have four main monetary policy tools.

Monetary Policy Definition Types Examples Tools

Economics Monetary Policy Explained With Examples Civilsdaily

Monetary Policy Instruments Targets And Goals Download Scientific Diagram

Monetary Policy Framework In India Springerlink

Difference Between Monetary And Fiscal Policy Economics Help

Monetary Policy Vs Fiscal Policy Economics Help

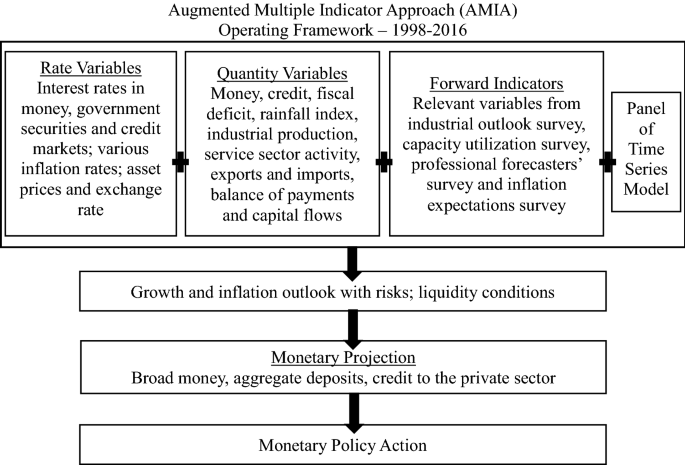

Monetary Policy Framework In India Springerlink

Monetary Policy Of India Bba Mantra

What Are The Instruments Of Monetary Policy Of Rbi Economics Shaalaa Com

Monetary Policy Of India Everything You Should Know About Clear Ias

Tools Of Monetary Policy Stellar Ias Academy

Monetary Policy Framework In India Springerlink

Monetary Policy Tools And Money Supply In India Civilsdaily

Monetary Policy Objectives Tools And Types Of Monetary Policies

Monetary Policy Types And Instruments In India Paper Tyari

Monetary Policy Of Rbi Objectives Instruments Process Thesisbusiness

Monetary Policy Tools Mexico Brazil And India Download Table

What Are The Instruments Of Monetary Policy Business Jargons